Between April and May 2025, the Ghanaian cedi staged a remarkable rally, strengthening from around GH₵15.50 to GH₵10.30 per US dollar in just five weeks.

According to GhanaRegions.com analyst, several months it remained stable, trading between GH₵10.3 and GH₵10.5. But by mid-August the tide turned.

Within three weeks the cedi weakened to GH₵11.90 and has now crossed the GH₵12 mark on the interbank exchange market — its first time above GH₵12 since May.

In the third quarter of 2025 the cedi has become one of the worst-performing currencies worldwide. This article explains why.

1. What Drove the Cedi’s Strength Earlier in 2025

- Tight Central Bank Support: The Bank of Ghana released foreign exchange into the market and tightened monetary policy to cool inflation.

- Gold and Cocoa Earnings: High global prices increased Ghana’s export revenues.

- IMF Programme Confidence: Reforms under the IMF programme restored some investor and business confidence.

- Diaspora Remittances: The strong exchange rate temporarily encouraged inflows. These combined to push the cedi from GH₵15.50 to GH₵10.30 per dollar.

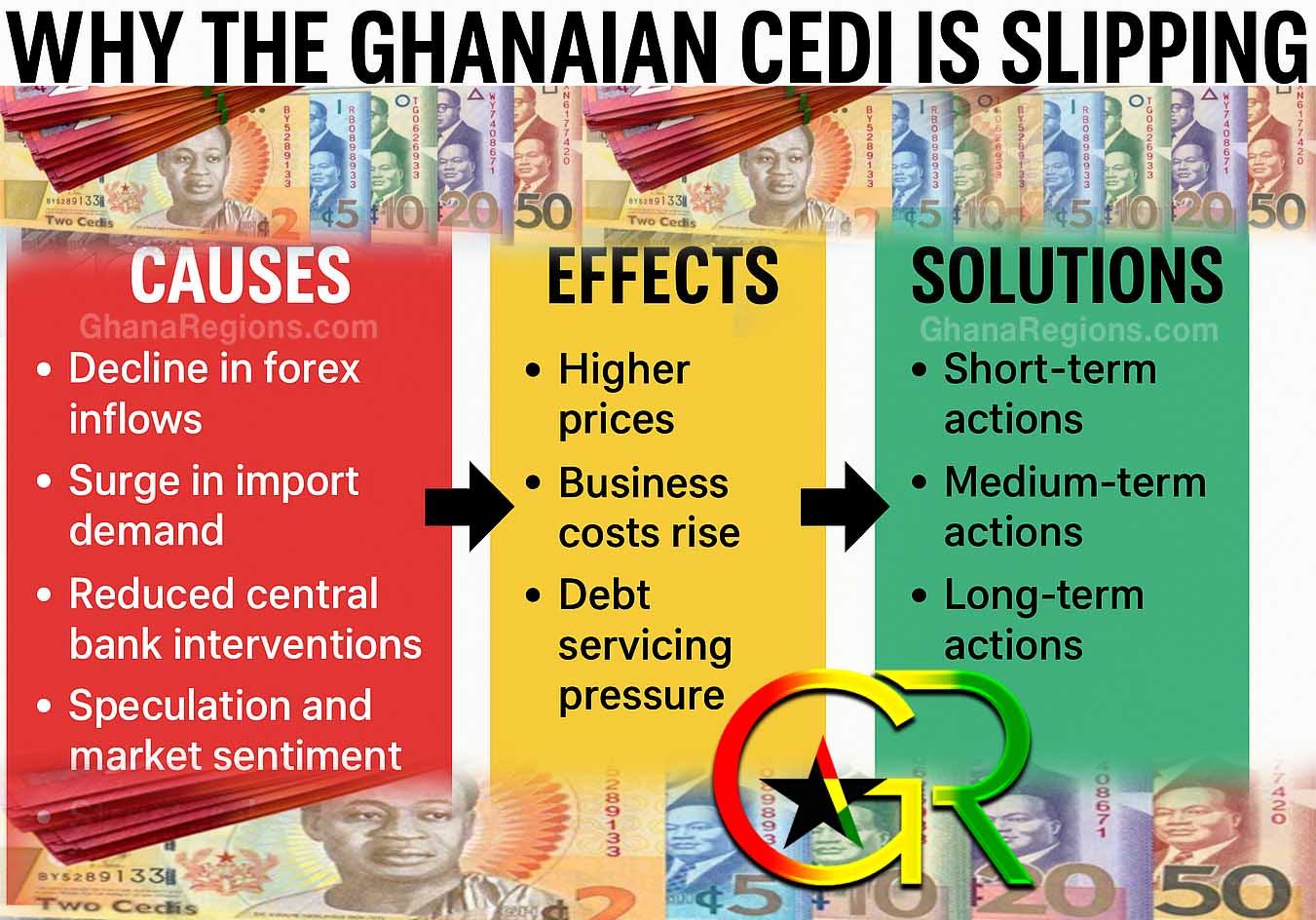

2. Why the Cedi Is Depreciating Again

A. Decline in Forex Inflows

Many Ghanaians abroad delayed remittances, waiting for better rates, and some export proceeds were held offshore rather than converted. This reduced the dollars available in Ghana.

B. Surge in Import Demand

Importers rushed to buy goods and pre-order stock when the cedi was strong, creating a surge in dollar demand. As more dollars were needed to pay for imports, the exchange rate shifted.

C. Reduced Central Bank Interventions

The Bank of Ghana scaled back its dollar sales after warnings about heavy interventions and dwindling reserves. With less supply, the cedi came under pressure.

D. Speculation and Market Sentiment

When businesses and traders sense that the currency might weaken, they hold onto dollars or delay selling exports. That accelerates the depreciation.

E. Structural Weaknesses

Ghana still exports mainly raw materials and imports most consumer goods. As long as the country’s production base is weak, pressure on the cedi will return whenever inflows slow.

3. Effects of the Cedi’s Depreciation

Higher Prices: Imported food, fuel, medicine, spare parts and construction materials become more expensive.

Business Costs Rise: Companies relying on imported inputs see costs jump, potentially leading to price hikes or layoffs.

Debt Servicing Pressure: Dollar-denominated government and corporate debts require more cedis to repay.

4. How Ghana Can Stabilize the Cedi

Short-Term Actions

Incentivise remittances through official channels.

Smooth but transparent Bank of Ghana interventions to reduce volatility.

Prioritise essential imports; discourage luxury imports.

Medium-Term Actions

Process cocoa, gold, timber and bauxite locally to earn more from exports.

Strengthen agriculture and manufacturing to replace imports.

Digitise government services to fight corruption and leakages.

Long-Term Actions

Industrialise and build export processing zones.

Develop renewable energy and technology sectors to diversify earnings.

Engage the diaspora with attractive investment products and reliable land/property systems.

5. Outlook for the Rest of 2025

If inflows pick up and import demand slows, the cedi could stabilise back near GH₵11–11.5. If not, it risks drifting higher — GH₵13 or more per dollar — especially toward the festive import season. The key will be confidence, disciplined policy, and boosting domestic production.

The cedi’s story in 2025 shows both how quickly Ghana can recover and how fragile that recovery remains. Without a deeper shift from consumption and imports toward production and exports, the currency will stay vulnerable to swings in remittances, commodity prices and speculation. With honest governance, disciplined spending and a focus on local production, Ghana can turn its rich resources into a strong and stable currency.

![Morocco knock out Spain on 3-0 penalties to reach FIFA World Cup 2022 quarter-final, Morocco vs Spain (0-0) (3-0) [Video]. Morocco knock out Spain on 3-0 penalties](https://ghanaregions.com/wp-content/uploads/2022/12/Watch-Morocco-vs-Spain-0-0-and-3-0-penalties-218x150.jpg)